SUPPOSITORY

It all begins with a parking ticket issued by the University of Toronto. A very typical scenario, especially considering the campus is located at the heart of the city, any space at all comes at a cost at all times. The only difference is that this time, the university is ticketing not someone outside of the campus but inside the campus; a scenario that shows the very contradictions and limitations of the very economic paradoxes and deadlocks of present globalization. A perfect example to the concept that any attempt to internalize a countries’ economy, the return to domestic manufacturing, the domestic consumption of produced goods and labours, or in other words, the impossible attempt at the concept of “self-sufficiency” will inevitably end with catastrophic failure. It is not a moral or ethical conflict, especially considering the dire environmental damage that threatens our existence, but one of shear practicality of the impossibility innate within the process of Exchange itself that causes the failure. Much like a short circuit, if at any time the positive and negative polarities come into direct contact, the most violent reaction occurs with this equilibrium bringing the entire system to its destruction.

The very moment that the parking ticket was issued, something contradictory happened, what was assumed a commercial exchange through the parking violation that allows the campus to profit became a contradiction. All that happened was that the University itself, as a whole, merely transferred money from one department to another, passing money from the left hand to the right hand, in other words, nothing actually happened. That is to say, the university as a whole did not get any richer, relative production of surplus profit, through this commercial transaction. Regardless of how many bureaucratic loops that this transaction has caused through its commencement and the movement through the University’s many systems, it all represents complete stillness and motionless action; nothing happened. The only means in which the university can acquire a profit would be to ticket those outside of campus, (locals of Toronto, visitors outside of Toronto, tourists etc) pursue academic education and research (students pay tuition, research data can be sold, etc) and engage in external, outside of campus, commercial investments (University of Toronto is the largest land owners of all of Ontario, etc). That is to say, the only means the University of Toronto, as a complete entity, can produce profit is by engaging with what is outside of itself, to take in profits outside of its enterprise. In terms of growth and the prosperity of the University in general, this situation produces a set a priorities that defines its goals apriori regardless of any moral or ethical considerations. The survival of the university has little to do with the well-being of those that are internally part of the university, hence the need of unions and so forth to maintain a minimum level of decency for those inside its systems, unless one is somehow associated with the university’s needed transactions with the general Outside, the consideration of your well-being will always be secondary regardless of how vital of role. This situation sounds eerily close to the function of corporations, but in general, profit is the life blood to any commercial entity, Universities are no exception.

As commercial entities countries act in a similar fashion, the only means for a county to acquire more wealth is external to itself. Any attempt to equalize and create a situation of self-sufficiency will end in complete failure. For example if Canada tries to return to domestic manufacturing, internal domestic consumption of trade, all that would happen would equate to nothing. All that happens is the transfer of money from one Canadian to another Canadian; Canada itself does not get any wealthier or richer, nothing happens. The only means for Canada to become wealthier is to engage in exchange with countries external to it, where within the exchange Canada acquires more than what was given. Within the short term conception of this self-sufficient utopian conception, it would seem to actually work. What is happening during that time of increased prosperity would merely be the greater distribution of wealth among the general populace in its boarders as the wealth of the classes begin to be dispersed through the wealth disparity, but this increased general prosperity comes at an enormous cost of the inevitable stagnation and inflation. If all the commercial exchange that takes place is moving money from one Canadian to another Canadian how can any Canadian make any money, where is the wealth coming from? If the net worth of Canada is worth 500 billion dollars, and all the exchange that takes places becomes domesticated, regardless of the amount of exchange that may take place, the resulting worth would still be 500 billion dollars there would be no increase.

As quoted by Zizek, this conception of the self-sustained country is not foreign or new, one just has to look into history and current events to find the best example of this self-sustainability, North Korea (one just has to read the founders original manifesto); an attempt to become fully self-sufficient and the obvious price that entails of such an impossible endeavor. Of course, this economic allegory is far too elementary to capture the full complexity of what is happening, what is happening not only completely exceeds my limits of comprehension and the extent of this writing, but none the less, even with this simplified conception is important for it is a much needed attempt at lifting this fog of war which has besieged all the classes of society. One can think of this question of self-sufficiency this way: within the concept of equivalent exchange for there be an increase, this increase must stem from something and if the two sides of the exchange are equal where can an increase be found? More importantly the deadlock arises even before this question; it is the presupposition that an equivalent exchange can take place at all. To borrow the concept of Jean Baudrillard, what is taking place is an impossible exchange. There is no way to conceive equivalence to something not of itself, for example to trade an apple for an orange both of which are radically different from the other with no means of equivalence. Even to the extent of say trading an apple for another apple, unfortunately there are no two apples that are molecularly identical in its complete complexity. Hence all exchange stems from this very impossibility. The way in which capital, the process of both simultaneous material and social exchange, have circumvented this paradox is through the act of abstraction. ( A concept articulated by Zizek stemming from the Greek’s, where one separates what one produces with one’s hands and what is being produced in one’s mind, the birth of abstract thought itself) This abstraction is both necessary and crucial to humanity, yet it brought forth an entire series of problems along with it. By circumventing the impossibility of exchange, the paradoxes do not automatically cease to exist; it is merely articulated by other means. Since every act of exchange entails both a material and a social component simultaneously, it is the human factor which has to absorb the excess components of the very impossible. One just has to look at every piece of electronic equipment one owns, every piece of clothing one wears, every item of food that reaches one’s lips and of course those that live in the relative stable safety of prosperity in one’s country (Canada), just look out at the chaos of the world, at its very core at the heart of the unbearable pain one finds the very haunting excess of impossibility.

This impossibility of equivalence was acknowledged by Marx long ago, it was him that stated that if every exchange was a “fair” exchange no one would be making any money, there would be no way to accumulate wealth. It is from this stand point that one can begin to interpret and understand certain conditions of the current social economic conflicts amongst the current leading economies, specifically, the North American (American), European (EU), and the rising economies (mainly China and the burgeoning India). There is a fundamental factor that needs to be addressed, one must always keep in mind that this impossibility is not a choice; it is not that one has a choice to be fair, loss was always innate within the exchange process. One can conceive of this concept at looking at Canada’s energy needs. Anyone that states Canada is energy self-sufficient has a grossly simplified understanding of energy. To perceive energy in its totality, one has to consider energy in all its forms and conversions. Perhaps Canada may have enough natural gas and oil to sustain its own stability, but is it only under the most basic of premise that this statement could possibly make sense. No country or landmass can reach any level of “self-sufficiency” this far off from the equator; it is just not physically possible to maintain a constant level of energy consumption with such radical fluctuations of climate and geographical limitations. The simplest way to understand this is to look at the limits of food production for Canada, as Canada only has four months of growing season annually. Energy in its totality is the complete understanding of the entire energy requirements to sustain life not at its theoretical minimum limits but at its current understanding of North American life. This intake must also be considered with its output, the waste itself is excess energy that must be dealt with, the rate of regeneration and the limits of sustainability are defined by physics, there is no instance where the conversions of energy could ever reach 0% or 100%. Within a closed loop any deviation from perfection would mean failure, the term perpetual energy is an oxymoron just like clean coal, for there to be energy there is already a loss. Have one ever seen a solar panel factory powered completely by the solar panels they manufacture? Yet when the crops all die and children grow with missing limbs as the barrels of toxic waste piles high, there is never that image of the solar panel at the other side of the rainbow. There is no way in which one can prevent change and produce change at the same time; in which the common understanding of stability in ones’ of life would be the price to pay for the change needed to sustain that fantasy in the first place.

EMESIS

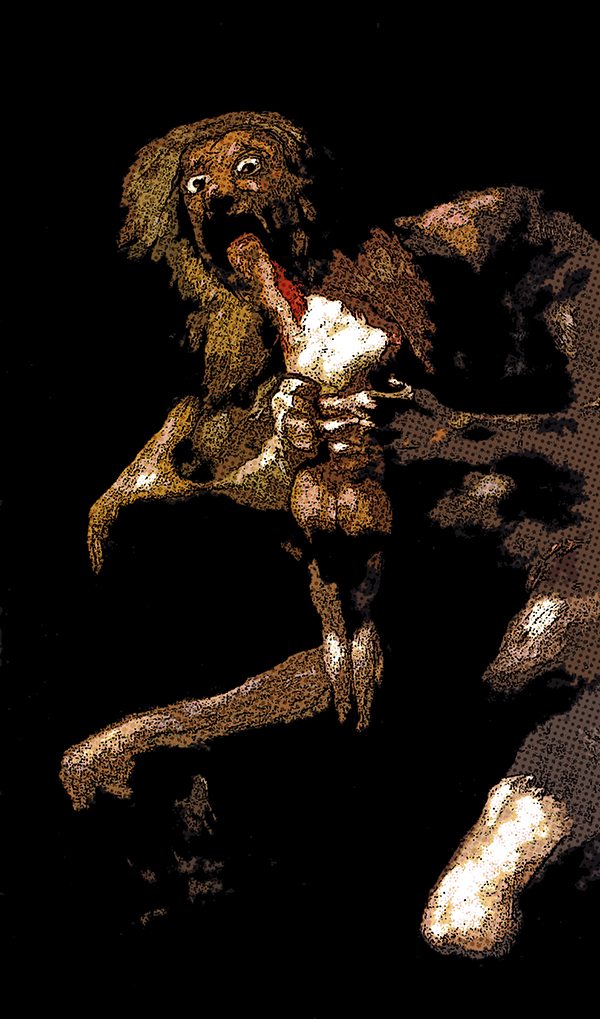

In conceiving of utopian futures, what is lost is this very utopia that society already lives in, the very impossibility that has sustained current society’s way of life and continues to do so is forgotten. It is precisely because of this misconception that society still views crisis as an option, a failure with a cause (wall street, greedy people, etc; it is not as those are irrelevant, but one rarely considers Marx’s famous quote first as tragedy second as farce), and not a natural occurrence of normalcy; quoting Eric Cazdyn, crisis happens precisely because capital is working perfectly. This lost dimension produces an ideological blind spot that can be seen in main stream society. In the recent movie Elysium 2013, directed by Neil Blomkamp staring Matt Damon, is the perfect example of missing the point completely by ignoring the most obvious systematic impossibilities. For example, in a society where robots can do everything, why is there still labour? In a technological era where everything is possible why then are there still class limitations? To simply say that it was a choice of the rich and powerful to withhold luxuries would be a grave misunderstanding. Just consider the ending of the film, by merely changing an N to a Y, somehow immortality was granted to everyone as if a gift as great as such was always just a change of a letter and all injustices, imbalances and all conflicts just dissolve with a simple yes. At such an ending one should summit to the bitter rage, much like the commonly misattributed phrase of Marie Antoinette, “Qu’ils mangent de la brioche” (During the famines in France under the rule of Louis XVI, as the people starved due to the shortage of bread, the response of the queen was the infuriating quote, let them eat cake), at how oblivious the directors really are towards the subject of poverty; heads must role for such ignorance. This is by no means in defense of those in power, but a cry to those whom are in their power to wake up to the reality of the system society clings on to for security not out of choice.

This perspective of the anti-interiority of the economy allows for an alternative understanding of why certain social economic arrangements are made, especially in regards to the realities of architecture and real estate. The reality of Canada can be seen by the often mysterious and misunderstood Condo market and property prices. There is no claim here to demystify something that cannot be completely understood or to completely explain the complexities of the economic model of such development projects, but this is an alternative understanding to why Canada needs condos. Simply put, the value of property is not in its solid components of the building or structure. What is being sold is the abstract approximation of space, voids, something without a solid identity. It is in such exchanges that the aforementioned impossibilities of exchange are truly brought to light. At least houses can be considered a piece of land (what is land?), but when one considers the prospects of a condo, essentially a box in the sky, value of such an exchange truly become ambiguous at where value can be extracted from. The only way in which something can exceed the value of itself something outside of it of more value must be brought into the system. In this case a box in the sky or a box of nothing, in and of itself a condo has very little in terms of value and worth and it is precisely because of this that the condo market has become primarily an external market of foreign investment. Property pricing is always a reflection of the overall economic situation of the region, the greater the value the greater the economic prospects. In its impossibility of exchange, property value is always based on a bubble economic model where the value is always artificially created (just look at property prices of identical houses in ones’ city separated by districts. Or even a greater example would be to look at a house with similar size and style located in San Francisco, Washington and Las Vegas; the prices are always artificial). Condos are needed to offset and maintain property value within the current globalization. Canada needs this flow and influx of capital to maintain its economic prosperity, and only cities with prospering economies can support a Condo market. Both in places like Toronto and Vancouver, this influx of foreign own Condo property provides relatively low cost rental housing which is completely taxable without the hassle of government funded programs and interventions to address the housing needs of the people. Without the influx of Chinese, Arab, Indian and other markets of currency flooding in to provide the needed capital for development there would be no stability for both Toronto and Vancouver. It is both an investment in Canada as a whole and for the developers where the developers always win out in this exchange, but nonetheless crucial for the Canadian economy. One should treat this exchange much like a banking exchange where for with the storage of one’s funds one is given interest in return. In providing flowing currency into the Canadian market, foreign investors (Condo owners) are given an interest of raised property value of which Canada can tax if sold. In the end, Canada gains through foreign investment into the Condo market, hence not only is this allowed it is encouraged as a means to grow the Canadian economy. The price to pay would be to destabilize a sector which is already unstable, but one must keep in mind that crisis was always already in place in order to address the impossibilities inherent in the exchange in the first place. That is to say, this system would fail regardless, even though what is or will be the cause of this failure in the future is what is precisely presently keeping that very same system afloat. In short, Canada needs its Condo market and needs foreigners to buy them, it is not a choice. It is just unfortunate that the racial card is the first line of defense used at the beginning of all class conflicts (Jews of WWII, Muslims in Yugoslavia, gypsies in Bulgaria, the Chinese in the Condo market, etc); the frustration is articulated or transubstantiate into the form of the Other. Here one should refer to Zizek’s explanation of Lacan’s concept of the 1+1=3, there is always a hidden a not seen in the equation.

In understanding this exteriority of economics, it becomes apparent that the survival of a countries’ economy lies not within itself but outside of itself causing the unfortunate circumstance where the overall prosperity of the people within the country have very little effect on its overall economic performance. Just look at the world’s richest and most powerful economies, they are also at the same time the places of the greatest injustices and irreconcilable wealth disparities; it matters really little to the economy of a country if one person has all the money versus the same amount of money dispersed amongst many if the money stays inside the country. This provides the perfect incentives for turning a blind eye to the white collar crime that happens on a daily basis. Tax evasion is an allowed transgression, much like other such transgressions in all its myriad forms, it is a systematic transgression structured into the system for the system; if letting taxes be forgotten will keep the money in the country versus Swiss banks then so be it. Nowhere is this concept better articulated then the United States of America. Still America as a whole within the current times is still the largest and most powerful economy in the world.

The American Dream as the name implies is exactly that, merely a conceptual Dream no different from any other utopian conceptions of reality. The loss of that dream is only a reflection of reality, a much needed wake-up call to the exorbitant cost of a life style that has always been an impossibility. The Keynesian model of economics was never meant to be a permanent solution to maintaining a stable economy, but merely a means to circumvent the inherent failures of the stagnant old world models of commerce, a key point that Keynes himself was fully aware of. What lies at the heart of this problem is what I would argue the inherent impossibility of exchange itself. There is never a fair price, the price is always far too much to pay. The stagflation of the 1970’s already proves my point towards the impossibility of an internalized economy. What America tried to do was create the ouroboros, not only can one have one’s cake, they can at the same time eat it too. The cost of such a conception can be seen by places like Detroit, a cost already far too little compared to the cost the rest of the world had to pay for the American dream. The main issue with a constant need to externalize a countries economy produces a paradoxical problem for the countries that are at the top of the global food chain. Only countries with enough of a middle class can have enough flowing capital to purchase foreign goods, in terms of America, the paradox lies in the fact that they hold most of the worlds’ largest industries and yet at the same time they are the largest consumers of global goods as well; in other words, the biggest consumer of American goods are largely American. In order to circumvent this paradox and impossibility the ouroboros was readapted, the snake is consuming its own tail the circuit is complete; yet for there to be an increase, the blood that is split as it consumes itself is not of its own but of the very Other that sustains its consumption. That is to say, the only way America can profit when only Americans are buying American goods is to offset the very costs of production where the price to be paid is transferred onto a third party to cover the difference. When someone purchases a T-shirt for $5 at Wal-Mart, the value of the T-shirt far exceeds that cost, yet both the consumer and the company gain by offsetting the cost of the product to third world countries (Pakistan, India, Malaysia, Vietnam, the list goes on…) that work in squalor conditions. The price to pay for a fair exchange is through the pain and suffering of the Other. Only in this way can highly developed nations and economies can continue to profit by consuming their own goods, the short circuit is resolved even though it is a closed loop. The resources are taken from elsewhere and is produced and manufactured at another location, but the brand remains same and the consumers can remain the same. As Zizek states in order for America to break even on an economic standpoint, they must consume a billion dollars a day worth of goods. As the ouroboros grows it must consume itself at a faster rate to sustain its life, the more it consumes the larger it grows from the very blood of the Other. It is from this offset that the modern economy can sustain itself and also explains its volatile nature of erratic eruptions of crisis to address anything that threatens its survival. The monster that they have created is no longer in their control; the ouroboros has a mind of its own, one that has fully adapted the very same mindset and violent ideology of its very creators.

The important point here is that even though there is a lack of choice to the situation, change is still within the realm of possibility; synthesis can happen by precisely embracing the impossible. One must acknowledge the price to pay is never enough, a concept completely lost within the current short circuits of mainstream consumption; for example Starbucks and the fair trade coffee, McDonalds with the children’s charity, all of which try to re-compensate for the very damage they have already done through the process of profit accumulation. Perhaps the best example of this impossibility of exchange would be the company American Apparel, in attempting to bypass reality and achieve the utopian internalization they are forced to face the very reality of the situation of financial failure. Attempts such as these resemble the very basic aspects of the Hegelian dialects, quite simply thesis and anti-thesis of the problem without reaching a stage of synthesis. This is exactly the concept of the impossible reply of the simple “yes” in the movie Elysium without truly understanding the immeasurable cost, but in reality one actually has to pay the price. One cannot hope to change the system without returning to the beginning to understand why the system has worked out this way in the first place. This short circuit is exactly that, one violent and brutal act and nothing more; where it continues to perpetuate the very problems and maintains the very impossibility of the system. As Zizek’s explains in order to tackle poverty, one has to imagine a future where poverty is no longer a possibility. The worse thing that a master that can do is to be nice to the slaves so that the slaves may never revolt and it is precisely this charity that one witnesses within this short circuit consumerism. One should see these given liberties as merely like the story of when Zizek recounts Catherine the great hearing her slaves slander her behind her back and yet she turns a blind eye to such incidences; it is precisely these allowed transgressions that keep them enslaved to her. It is here at this point of the impossible that synthesis may be reached, if one gives up everything including the goal itself perhaps it is the price needed to pay for that very exchange. In Zizek’s words, “in order to make the step from reformism to radical change, we must pass through the zero-point of abstaining from acts of resistance which only keep the system alive. In a strange kind of release, we have to cease to worry about other people’s worries, and withdraw into the role of a passive observer of the system’s circular self-destructive movement.” The ouroboros will kill self in its consumption, “to maintain the system, those who refuse to change anything are effectively the agents of true change: effecting a change in the very principle of change.” The saving grace to globalization is precisely the thing that dooms it; within this forced externalization it maintains that ones’ very survival completely relies on the survival of the Other. It is within this impossibility that the irreconcilability of the very Other is the impossibility itself. It is the Others’ survival, a cost that maybe our own very survival, that will save us in the end; a choice-less impossibility that one at the verge of willing to lose everything can finally embody as their own.